It is well reported that COVID-19 has accelerated the predicted timeline around E-commerce participation in total retail sales. The growth realised, and retained, has seen the future arrive early, with consensus that online retail spend has jumped forward at least a few years.

Australia Post reported a 10% increase year on year in household online participation, with almost 9 million households making an online purchase in 2020. This growth saw online predicted to represent 15% of total retail spend. Across the Tasman, NZ Post have reported an increase in online spend over 2019 of 25%, taking online sales to 11% of all shopping.

This level of growth in one year has not been without its challenges, however, it has been impressive to see how the retail industry and associated logistics partners have adjusted to meet the new customer demand for online sales.

With a new baseline set, and the further opportunity for growth it is imperative that retailers and logistics partners reset their supply chain strategy to respond to customer demand change across channels and to develop the new capabilities required for seamless, unified commerce.

The requirement to make changes in retail supply chain structures is now recognised more than ever as it is critical to customer experience and the associated success of retail organisations. Doing nothing is not an option.

Whilst recognising that most retailers have taken actions to address some of the short-term challenges, only a few have truly set the foundations for their future supply chains. Building a customer centric supply chain with the capabilities to support omnichannel retail requires a strategic roadmap of building blocks that iteratively increase customer experience alongside supply chain agility and efficiency.

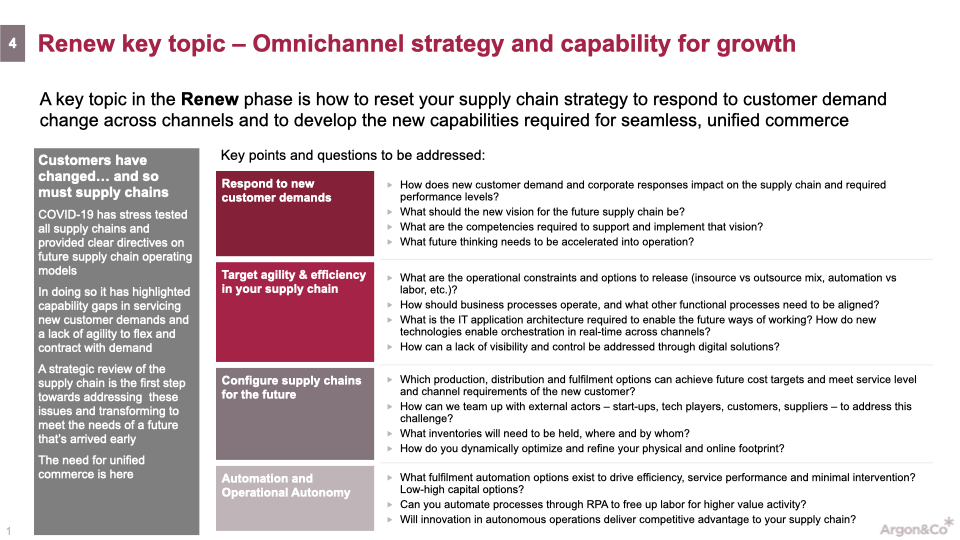

The first step is a strategic review. We have posed a few questions below that help to define the key principles that should underpin a future fit supply chain.

In the first of a series covering all of the topics outlined above, we have asked our good friends at Fuzzy LogX, The Logistics Engineering Wizards to share some thoughts on automation and operational autonomy in the supply chain……

There’s really nothing like a once-in-a-lifetime, exceptional global event (like a pandemic) to really put your supply chain to the test. Most of us saw these localised effects during 2020 through the bare supermarket shelves which once housed Toilet Paper and the other most common household consumables. These severe replenishment shortages were the bull-whip-effect-like symptoms caused by our lean-thinking manufacturing colleagues who have migrated over to the Warehousing and Distribution industry over the last couple of decades as local manufacturing declined. They brought with them tools which had served them well in the process-driven world of production lines such as six-sigma and just-in-time. However, as we all now know, when you run too lean, you lack the ability to react. Just as quickly had the bean-counters been lauded for their reduced working capital through reduced safety stocks were they then chastised for leaving their businesses high-and-dry and stockless.

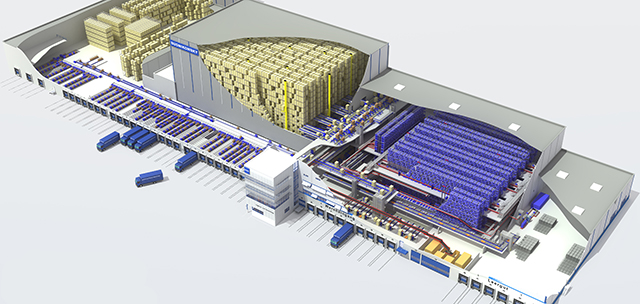

Source: Witron RFC

However, the true effects of the pandemic were felt within the four walls of distribution centres around the globe. Because the moment that every business’ all important store assets were forced to close, the humble warehouse became the fulfilment superstar. In order for a business to survive it had to quickly pivot from fulfilling large orders to stores to fulfilling unique and small orders to people’s homes.

Most businesses saw growth in their online and Business to Consumer (B2C) channels that they had never prepared for. But just as we always do in times of great adversity, the global distribution and fulfilment community was up for the challenge and we have had to learn a lot about how to deal with changing order profiles and what technology to use to make the most out of every logistical movement in the fulfilment chain.

Most people never really think about the effect a change in outbound order profiles may have on an operation until they’re staring down the bottle of a constrained and bottlenecked operation failing to meet their customer’s needs.

Warehousing and logistics has been experiencing a change in order profiles for quite some time, but unless you looked closely, most people have missed it. B2B channels can hide changing order profiles within volume fluctuations, but until you really move into B2C fulfilment you never really feel the pain. Furthermore, when your only engagement with your market is online, the fulfilment experience now becomes integral in customer retention.

If you imagine a legacy operation set up to ship orders to stores you’ll usually find a mature and usually inefficient picking process which works its way through a fixed manual pick face building orders. The inefficiency of the manual pick operation is usually hidden by the ability to build pallets by picking cartons along the pick face, add labour as required and the lack of a dedicated packing requirement at dispatch.

If this legacy operation then needs to pick B2C orders which usually have 1-5 units on them, they find themselves having to walk the whole pick face to pick a single order which then must be specially packed, void filled, weighed, dimensioned, consigned and sorted before it can be dispatched out the door. The outbound fulfilment effort increases exponentially and one must work smarter not harder to achieve results.

The first step in shifting into a B2C operation is to review your processes. This is where the techniques our friends from Manufacturing have taught us will come in handy. Understanding the Pareto, Velocity and Demand drivers of your product range will allow you to design a specialised split case pick face to replace your legacy full-case pick face with a dense and optimised area to reduce walking.

But now you’ll quickly find that your current discreet (single-order-at-a-time) picking process will be hindering you greatly. You’ll need to look for ways to optimise your order picking using Batching (pick by SKU) or Clustering (Pick multiple discreet orders concurrently) functionality through your order fulfilment or WMS system. A low hanging fruit for B2C is always single line single unit (SLSU) orders as they can be batched together and sent straight to a packing bench where they can be packed relatively quickly.

Once you have explored the best-practise processes you can use, you will then need to review your technology stack and mobility devices to ensure you are able to rapidly deploy new devices for special events (such as Black Friday) but also to ensure that you are able to maintain a high level of accuracy for every pick through increased user functionality and system-driven interactions.

Mobility technology such as voice, hands-free and even augmented reality glasses are helping to drive efficiency and accuracy in picking. But even with the best technologies available, this is often not enough to meet the large throughput fluctuations and continued growth in demand.

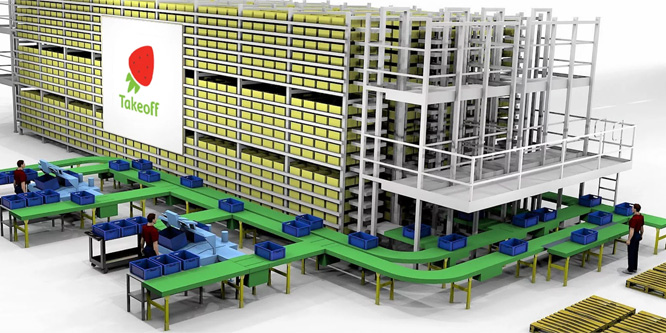

Source: Takeoff – MFC

You see, as much as you can optimise your manual operation, the bottleneck (and cost) is usually in the walking time it takes to move through your warehouse to pick your orders. Traditional picking methods are called person-to-goods because a person needs to walk to the pick face.

This is where it is necessary to think strategically and plan to introduce some level of Goods-to-Person (GTP) Automation to your fulfilment chain. Although there are many different types of automation technology, broadly speaking there are three key classes of automation being deployed globally which help to address the challenges with B2C distribution:

- Rapid fulfilment centres (RFCs) – these refer to the introduction of goods-to-person and other automation types into a B2B and B2C operation to assist with pick a wide variety of products. These solutions can be quite wide ranging and can incorporate Pallet and Carton ASRS technology, GTP each picking picking solutions, Order Packing and Sortation technologies in an integrated package designed to deliver a reduced cost per order across the board.

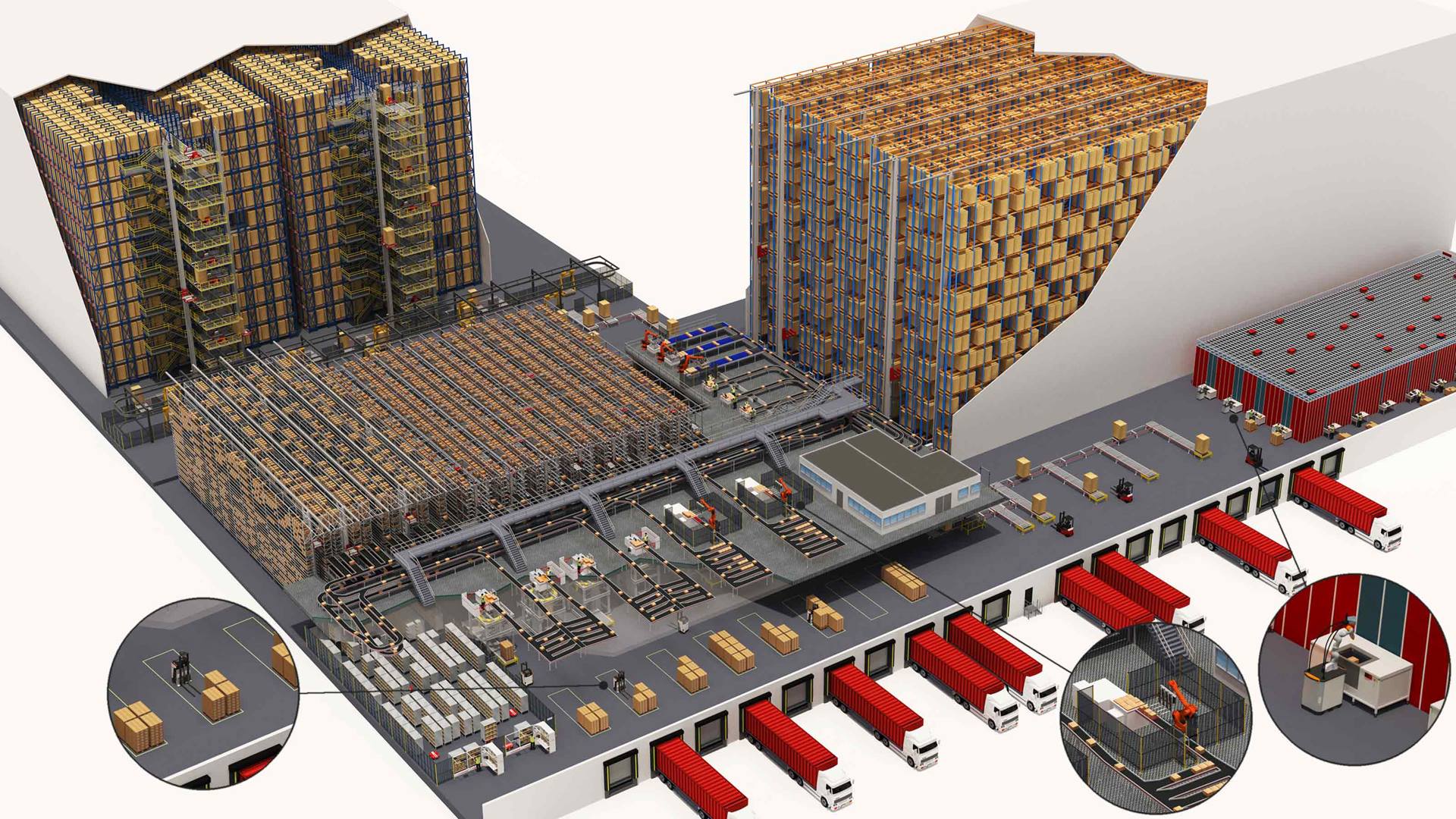

- Client fulfilment centres (CFCs) – these refer to specialised B2C only operations which are usually designed to meet the split-case picking requirements for small profile orders which are then packed and shipped directly to consumers homes. They require an increased picking and packing effort which is usually highly automated to minimise order-turnaround times and reduce labour requirements for what is usually a high-touch fulfilment operation.

- Micro-fulfilment centres (MFCs) – both CFCs and RFCs are usually standalone warehousing and distribution operations which must hold they’re own stock from which to replenish their outbound operations. However micro-fulfilment centres are about housing small automation systems within traditional retail assets (stores) in order to provide an added level of convenience for an instore customer or to provide omni-channel fulfilment of B2C orders direct from store stock.

Source: Swisslog RFC

All of these classes of technology are being researched and implemented by your competitors and peers alike. It’s all about understanding your strategic market goals and homing in on how you will achieve the ultimate customer experience, because that’s where the battle lies now.

If you would like to discuss automation and your fulfilment chain, contact us today for a no-obligation call.