Measuring Days Payable Outstanding (DPO) does not allow effective performance steering of a Procure to Pay (P2P) process.

We are all told that an effective P2P process has a healthy DPO measure – but what is healthy?

If DPO is high, then cashflow is strong, but vendors are constantly chasing their money, too low and cash leaves the business faster than it’s coming in, how do we find the proverbial ‘just right’?

The answer lies in the detail, DPO is an Inside Out, Lag measure (i.e. it measures your own performance, in the past), it is good for your own confirmation bias and broadly summarises past performance, but it is useless for steering the activity of today and tomorrow.

DPO is calculated as: ( Average Accounts payable / COGS ) x # days in the accounting period.

For example: If the output of this calculation returns a DPO of 40 days for one period and then 41, or 39 days for the next, does this really mean things have got better or worse? We know that the real process heartbeat exists in the detail – and knowing that, how could you possibly steer your business on DPO?

You may be able to take some high level decisions based on DPO – you could aim to increase your AP, or you could decrease COGS (both increasing DPO) – however neither decision explicitly connects to the process intention – to deliver products or services to your organisation and then make the subsequent payment.

By steering on DPO, you are not seeing the live performance or variability within the P2P process, and it is this variability that causes your vendors (and therefore you) pain.

If you felt sick and went to the doctor, you would be surprised if they assessed your current symptoms by referring to data they gathered three months ago. They may use your historical blood pressure/weight/o2 levels to understand your general health, but they would take todays readings, and use this live data to steer you towards becoming healthy again.

A P2P process is no different, a process heartbeat needs to be established, this should be real time (i.e. happening now), reportable and reflective of the process health.

Taking an Outside In view

How about if we took a look at this process from an Outside In perspective? Vendors want to be paid for each of their goods/services supplied, On Time.

Therefore, if you were able to measure On Time Payment at an order level, and zoom into individual events that contributed to poor process performance (that will almost certainly not show in an aggregated DPO measure), in real time, without the need for hours of ad-hoc data extraction and analysis, why wouldn’t you?

If you could also then model this improvement into future process performance, why wouldn’t you?

If you could visualise the pain of variability that poor process performance causes your vendors and then systematically eradicate that variability to make the pain less, why wouldn’t you?

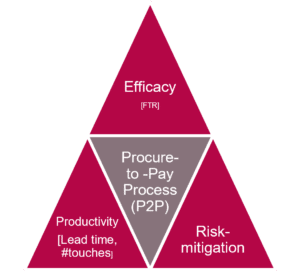

There are three broad areas that should be in scope to assess your P2P performance: The efficacy, productivity, and capability to mitigate risk.

Within these categories the actual measures will likely include

- Lead Times (On Time, Cycle Time)

- Processing costs (Cost of invoice, Spend Under Management),

- Accuracy (First Time Match, First Time Right).

By accurately maintaining positive performance in these areas, you will limit business interruption risk and support the positive cashflow of your vendors – this will also lead to strong DPO performance…

At Argon & Co, we support businesses to find the right process heartbeat. We use Data Driven Leadership to help process owners steer with data. Process Mining allows us to zoom into your P2P Process with pace and accuracy.

Ultimately, we help you to identify improvement opportunities and deliver the real business impact.

If you know that process health is more than just DPO, and want to investigate how you can better steer your performance, based on the right process heartbeat, call us today – why wouldn’t you?