The global retail sector has been significantly influenced by Black Friday, a phenomenon whose ripple effects have transcended its American roots to leave a lasting imprint on the retail landscapes of New Zealand, Australia, China, and the broader Asia-Pacific region. In Australia, this increasingly important retail event has captured consumer interest as shown by a 8% YoY (year-on-year) uptick in retail spending recorded last November 2022¹.

Ben Dorber, the head of retail statistics at ABS, underscores this trend by highlighting the increasing popularity of Black Friday. He points out that consumers are increasingly holding off on their purchases to “take advantage of discounting” in November, particularly as we are seeing cost-of-living pressures. “With retail turnover increasing by more than +1% in all states and territories, its clear Black Friday sales are becoming increasingly popular across the country.” – a further indication of broad-based consumer enthusiasm in ANZ and beyond.

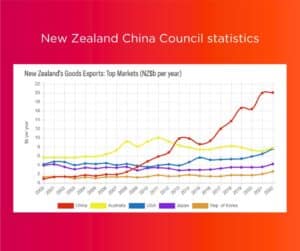

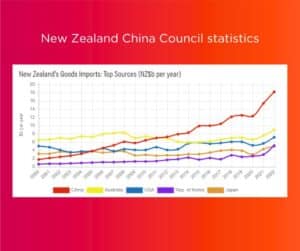

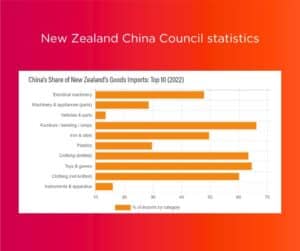

The retail narrative isn’t solely influenced by internal market dynamics, but also significantly shaped by the international trade relations that New Zealand and Australia maintain, especially with China. New Zealand marked a significant milestone with its exports to China, valued at NZ$20 billion, as of Dec 2022, double the worth of exports to its next biggest market, Australia1. New Zealand’s trading connection with China burgeoned further as China became its top trading partner by the end of 2022, with a two-way goods and services trade totalling NZ$40.32 billion2.

On the other end – despite political tensions in recent years, Australia and China remain deeply reliant on each other for trade, with two-way goods and services trade reaching AUD $248.6 billion in 2021. China is still by far Australia’s largest trading partner, accounting for over 38% of total Australian exports in 2021. When we take a closer look at Australia’s own retail market trade of $35b AUD, we see a 1.5% rise in September 2023 compared to 2022, showing an upward trajectory in the market34. These statistics highlight the ever-dependent relationship that New Zealand and Australia have with China in the modern era.

Fashion Retail Industry Deep Dive

The fashion industry forms a vibrant segment within the retail sector, as well as a key pillar of focus during Black Friday, mirroring global fashion trends and local consumer preferences. In Australia and New Zealand, international brands have found solid ground, buoyed by a growing middle-class consumer base. The fashion market in New Zealand is on a growth trajectory, with revenue projected to reach US$1.35 billion in 2023. This projection also anticipates an annual growth rate (CAGR) of 12.08% from 2023 to 20275. In Australia, the fashion sector is also significant, with revenue from the apparel market anticipated to reach $20.2 billion by the end of 2023, contributing 1.5% to the nation’s GDP6. Alongside this, Australian fashion retailers are navigating a market resurgence, underscored by a recalibration of strategies towards consumer-centric offerings.

The narrative of fashion retail interplay among Australia, New Zealand (ANZ), and China is a fascinating tale of global market dynamics, cultural exchange, and strategic adaptation. The domestic fashion industry, however, has witnessed a contraction due to the influx of global brands and the rise of e-commerce platforms7. For instance, international household brands like Zara and H&M have established a strong presence in Australia, intensifying the competition for local brands. This scenario has propelled Australian brands to eye the Chinese market and beyond, driven by its vast consumer base and growing middle-class affluence.

As highlighted earlier, trade dynamics between Australia and China have had their share of ups and downs. Despite a 4% dip in trade value in 2022, the Chinese market remains a lucrative venture for Australian fashion brands5. The example of Australian fashion startup Cettire highlights this. It is accelerating expansion into China, having announced a partnership with e-commerce leader JD.com to launch there in 2022, aiming to replicate its viral growth at home in the world’s largest luxury market. Cettire has hired engineers to build China-specific features and plans to leverage JD.com’s 550 million customers8.

New Zealand’s fashion retail sector, albeit smaller, is also growing in its size and footprint, with a unique focus on sustainability. Brands like Icebreaker have made significant strides in penetrating the Chinese market and beyond, resonating with the respective markets consumers’ growing affinity for sustainable fashion9. This coincides with the latest trade trip statements the New Zealand Prime Minister made to China. Chris Hipkins attended a product launch event in Shanghai promoting partnerships between Kiwi companies and Chinese firms to boost bilateral business, vowing full government support for Kiwi brands expanding in China, building on 50 years of diplomatic ties and predicting the new deals will drive over half a billion in additional annual sales by 202610.

China, with its immense consumer market, is a pivotal player in the ANZ fashion retail narrative. The rising middle-class consumer base, not just in China but also in the wider Asia region, presents a vast market for ANZ brands. This demographic, equipped with increasing disposable incomes and a refined preference for quality, opens up significant market avenues, not just for trading events such as Black Friday, but on a sustained ongoing basis. To take advantage of these trends that we’re seeing in the region, local and multi-national companies (MNCs) should look to consider the following strategies for success;

3 key takeaways for MNCs:

- Strategic market diversification with cultural adaptation: Venturing into regional markets such as China provides a resilient buffer for ANZ brands against domestic market fluctuations and global supply chain adversities. Fundamental to this is need for a deep understanding and adaptation to local cultural preferences, given the diversity in the region. Strategic diversification into different consumer segments, especially during retail-centric events like Black Friday, can further enhance brand presence and revenue streams. A nuanced grasp of local market dynamics underpins sound operational decisions, aiding in proficient inventory management and more accurate demand forecasting, thereby aligning supply chains with consumer demand trends effectively.

- Leveraging sustainability for competitive edge: The global consumer narrative is gravitating towards sustainability, with China’s emerging eco-conscious consumer base presenting a substantial market for ANZ brands with a strong sustainability ethos. Beyond being a market entry strategy, sustainability serves as a supply chain imperative. Incorporating eco-friendly practices from sourcing to production can lead to cost savings, risk mitigation, and enhanced brand reputation. Engaging with local suppliers and SME partners who uphold similar sustainable values can further streamline operations and reinforce supply chain resilience in these markets.

- Digital transformation: The shift to digital platforms is indispensable in the modern retail landscape. As we have seen with Cettire, it has demonstrated how a digital-centric approach can navigate retail challenges and extend consumer outreach, which will no doubt be leveraged during shopping events like Black Friday. This transition is in sync with the global trends towards e-commerce, significantly accelerated by the pandemic. On the operational front, digital transformation also finds its way into facilitating enhanced supply chain visibility, real-time inventory tracking, and data-driven decision-making.

The interplay of retail dynamics between Australia, New Zealand, and China, accentuated by events like Black Friday, defines the interconnected global retail landscape. As ANZ brands eye the expansive consumer market in China and beyond, strategic market diversification, embracing sustainability, and digital transformation emerge as 3 key strategies. These strategies not only resonate with the evolving consumer preferences but also mitigate operational risks, especially in the face of global supply chain disruptions. For MNCs, a nuanced understanding of these market dynamics, coupled with actionable insights like fostering local partnerships and aligning with consumer-centric digital platforms, can unlock significant retail opportunities across the Asia Pacific.