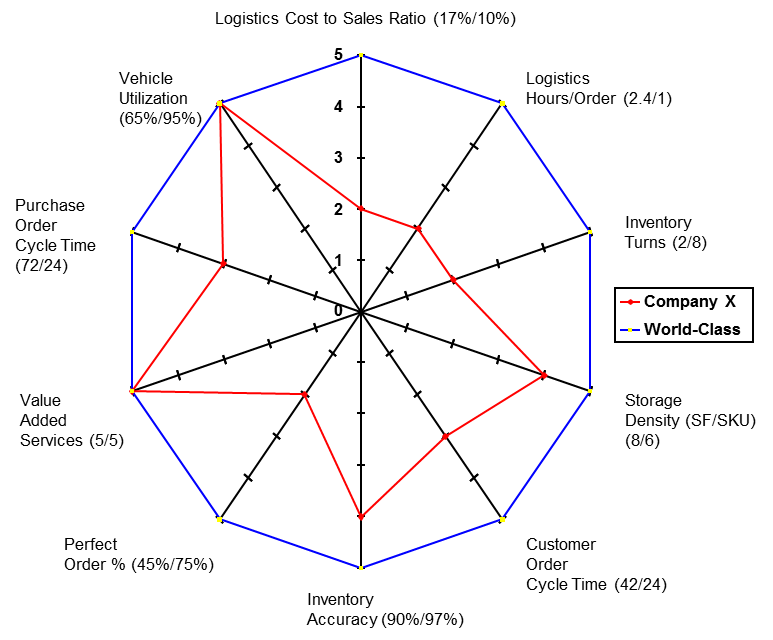

The logistics performance gap analysis is used to compare logistics key performance indicators with world-class indicators. The gap analysis enables assessment of strengths and weaknesses; identification of complementary logistics partners; and development of cost-benefit justification of a world-class logistics initiative. Many companies must collect and summarize their operational performance data in order to develop many key performance indicators if they are not currently

Once the gaps are identified, the team should use them to better understand the strengths and weaknesses of the organization. The gap analysis enables the company to seek partners with strengths that can compensate for or complement the weaknesses or capability gaps which the company should strive to fill. A decision to outsource operations will then yield an evaluation requirement to leverage the expertise of potential partners to fill the most significant gaps in performance capability. Remember, that filling the gaps will take some time even for highly qualified partners as the company must adapt and develop internal processes to capitalize on the improved capabilities.

The team must evaluate financial opportunities relative to current cost factors, capital investment requirements for closing performance gaps, financial structure and objectives, volume variability and company risk tolerance. The analysis should consider current unit costs and the mix of fixed and variable costs and potential to convert fixed to variable cost. If gaps exist in technology capability, the team should estimate the capital investment required to adequately fill the technology gap and the time required for implementation. If the volume fluctuates significantly, conversion to variable cost will enable the company to more closely match period costs to volume resulting in a more stable cost per unit per period. Elimination of facility leases or sales of distribution facilities or fleet operations can have positive balance sheet impacts which can contribute extra savings or benefits to the outsourcing justification.

World-class logistics organizations partner with strategic providers of various logistics services including transportation management, transportation services, freight forwarding, customs brokerage, warehousing, logistics information systems, benchmarking, logistics consulting, and logistics professional education. The outsourcing decision for any one of these logistics services must be reviewed periodically (as the business and logistics environment is changing perpetually) and carefully (since it is typically more difficult to re-insource an activity). Outsourcing decisions should consider the following decision criteria to justify outsourcing a logistics activity. Consider logistics outsourcing if:

- Proven 3PL providers support your industry or support businesses with similar operational attributes AND

- Economies of scope and scale are available for a 3PL AND

- 3PLs potentially have a significant cost and service advantage AND

- Outsourcing will fill operational performance gaps AND

- Outsourcing will not adversely impact customer communications and relationships AND

- The 3PLs have a better warehouse management system or can effectively operate using your existing WMS

Once the decision to outsource is made, the team will begin the implementation process by creating the outsourcing plan and preliminary budgets and schedules.

Remember to check out the first and second posts in this series regarding Outsourcing Motivations and Assessment.

As of September 8, 2020, Crimson & Co (formerly The Progress Group/TPG) has rebranded as Argon & Co following the successful merger with Argon Consulting in April 2018.