Throughout the COVID-19 pandemic, companies have faced unprecedented challenges to their supply chains. They not only saw operations deal with panic buying, labor shortages, and a dramatic demand shift away from travel and towards industries such as consumer electronics, entertainment, and home furniture, but also saw a fundamental adjustment of consumer behavior that will have long-term implications. Going forwards, operations that were previously built on efficiency will need to think differently to ensure they have the flexibility and resilience to respond to future disruption.

The huge drop in demand in industries such as travel and leisure, and the surge in demand in industries such as consumer goods, electronics, and home improvement saw shipping container and freight prices soar. At its peak, the global container freight index was more than four times higher than at the start of 2020 [Statista]. The causes and effects of almost unprecedented levels of supply chain disruption are widely known:

- A move to widespread home working caused a surge in industries such as consumer goods, electronics, and home furniture, with their products primarily sourced from the Far East

- Large-scale global PPE purchases sourced from the Far East

- Widespread mothballing of passenger aircraft significantly reduced available air freight cargo space

- Labor shortages caused by COVID-19 led to understaffed ports and haulage companies

- Further labor shortages caused by lockdowns reduced manufacturing capacity in the Far East interrupting the supply of key products

- The Ever-Given incident in the Suez Canal caused further delays of multiple weeks on one of the world’s primary shipping arteries

Any business dependent on Far East sourcing and sea freight looked for immediate alternatives to mitigate delays, including a rapid move to air freight to keep supply lines moving. For decades, global supply chains have been fixated on efficiency, cost reduction, and lead time optimization. The ‘just-in-time’ approach has led to huge savings in inventory and related costs, but when faced with disruption on the scale of the last 24 months, this approach has seemingly reached its limit. A method centered on stable and predictable arrival times struggled to respond when transport costs skyrocketed, and businesses looked to hold more stock in response.

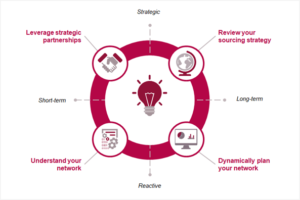

As the world emerges from the COVID-19 pandemic, businesses need to review what moves they should make to ensure they have the right balance of efficiency and resilience in their operations. To achieve this, companies need to adopt a mixture of tactical and strategic responses over both short-term and long-term horizons. Top of mind, when considering the response, should be that for modern operations, resilience and sustainability are now just as important as efficiency.

We outline a framework to help companies assess their options and develop a range of responses to future-proofing their operations for the decades to come.

Understand your network and cost base, and know your alternatives

Recent events have highlighted that businesses do not always know the major operational cost and service drivers in their supply chain and logistics networks.

- Continually analyze your cost base: understand the fixed and variable elements of your unit costs (e.g. port charges, fuel cost) – which are susceptible to change?

- Buy the right way in the short-term: continuously benchmark for lanes where long-term agreements are not in place and identify clear alternatives

- Map out the riskiest routes to understand where the major delays occur: which lanes are most likely to incur delays or lost time? Be aware of what options there are to move to different shipping lines or ports if needed

- Track shipments by using technology such as IoT within containers to provide real-time updates on the location: know how long containers have been in the port or on the boat, if you are incurring unexpected demurrage charges, or whether you can move product faster through different routes

- Know which are your most profitable products: create a clear plan to secure supply of those products at the expense of less profitable lines if needed

The above points can be used to enable rapid decision-making and proactive discussions to adapt plans, supported using real-time visibility.

Leverage strategic partnerships with logistics providers

For decades, companies have typically used third-party logistics providers to drive down costs and generate efficiencies, without fully utilizing their capabilities.

- Focus not just on cost, but on capability: leverage their global scale, flexible labor models, optimal locations, cutting-edge systems and extensive logistics expertise to build resiliency in your logistics network. Ask them what they are doing for other customers, and ensure that you are benefitting from their experience and scale

- Use the full range of their global networks: find the right locations for your business’s logistics and supply chain network, and secure capacity for now and the future

- Secure preferential rates and booking slots on capacity-constrained routes: ensure costs are minimized by sharing loads with other customers

- Establish a clear issue resolution process and a framework to track performance: work collaboratively to provide and update forecasts on key routes

Review your sourcing strategy

The Asia-Pacific region has often been the default location for low-cost sourcing, but that needs to be reviewed and re-checked for more resilient options based on business priorities

- Review market capabilities including and beyond current suppliers through a Request for Information (RFI), starting with a focus on tier 1: know their sourcing routes, which ports and shipping lines they rely on, and whether there are alternative locations available

- Focus on dual sourcing: consider how to diversify the supply base and sourcing locations for the most critical products or components to reduce dependency on sea freight and containers, and analyze the cost trade-off for that increased resilience

- Check your suppliers’ resilience levels: ask them if they have business continuity and disaster recovery plans in place, how robust they are, and whether they are aligned with yours. While tier 1 suppliers are crucial, don’t forget tier 2 – the Business Continuity Institute estimates that 40% of COVID-19 disruptions happened in tier 2 suppliers

- Consider the business case for near-sourcing versus low-cost country sourcing and be prepared to move to those alternatives if needed: understand when one becomes more cost-effective than the other, how the service levels compare and ensure that quality factors are considered in the total cost of ownership calculation

Set up your business to dynamically plan the network

Visibility of costs and volumes can enable Advanced Planning & Scheduling systems to optimize production and shipping locations to mitigate the impact of delays or price rises, by finding the best combination of volume and routes to market.

- Review your operating model: connect teams across geographies and business units to quickly make the best collaborative decisions

- Leverage your data: predict delays based on historical patterns and latest data (pre-, during, and post-COVID-19), and re-route shipments or re-allocate production capacity to alternative sites

- Build contingency into the network: understand where you have spare capacity and have plans to use it where needed

A combination of these responses will be needed to secure your supply chain and logistics operations as the world emerges from the COVID-19 pandemic – not just preparing but actively planning, for interruptions. While 2020 and 2021 may have been exceptional for disruption in sea freight and shipping containers, further disruptions are very likely, so ensuring that you are ready for the next crisis will help you win when it arises.

Authors: Rob Carlisle and Charlotte Harryman