Uncertainty seemed to be the overarching theme for transportation markets in 2025. Whether it was uncertainty around the economy, tariffs, geopolitical tensions, or regulation enforcement, transportation professionals certainly had a lot on their plates to deal with this year. US trucking markets continued to experience an extended period of readily available capacity and low rates, to the surprise of many (yours truly included). Players in the ocean market were nowhere near as lucky. The volatility of the last few years continued with wild price swings, shifts in trade patterns, and restructured ocean carrier alliances. The US domestic parcel market saw volume grow modestly, with Amazon and regional parcel providers applying pricing pressure while gaining market share.

Over the coming weeks, we will be providing our outlooks for 2026 for truckload (TL), less-than-truckload (LTL), ocean, and parcel freight markets. We hope our thoughts and predictions help shippers pragmatically plan for, and navigate, the continued uncertainty that 2026 is certain to deliver.

2025 Truckload Market Recap

We acknowledge there are numerous “flavors” of truckload transportation based on combinations of:

- Equipment type: dry van, temperature-control, flatbed, bulk, intermodal

- Geographic coverage: national, regional, local

- Length of haul: long-haul, medium-haul, short-haul, and shuttle

- Contracting options: dedicated, one-way contract, one-way spot

Capacity and pricing trends in all these different iterations will of course have significant variation. When we talk generally about the “truckload market”, we are referring to dry van, one-way contract carriage as that is the largest and most common variety.

After 2 years of deflationary truckload pricing (2023 & 2024), we expected that pricing could not go any lower in 2025….but it still did. Shippers were comfortably able to cover their freight and do so at price points that were flat or even a little below the previous year. While carrier capacity continued to exit the market, truckload volumes trended downward as well. So, the expected pressure on rates never really materialized.

Source: Freightwaves SONAR Contract Load Accepted Volume Index 2024 (Green) and 2025 (Blue)

Yet, similar to 2024, some rate pressure was building as the market got to the end of the year holidays. Tender rejection rates (where a load is offered to a carrier and the carrier rejects the load deciding they have better options) rose in the last few weeks of 2025 even against the reduced volumes seen throughout the year. This pressure was a supply phenomenon (carrier capacity) based on carriers exiting the market. Those exits were likely a mixture of poor market fundamentals, stricter enforcement of English language proficiency (ELP) laws for drivers, and heightened scrutiny on drivers who possessed a non-domiciled Commercial Driver License (CDL). The segment of the driver population affected by these measures is hotly debated, but the consensus was there was some impact to the pool of available drivers and thus an impact on carrier capacity.

2026 Truckload Market Outlook

As we move into 2026, writing this article is leading to an extreme feeling of déjà vu. Many of the proclamations from last year’s predictions again seem appropriate for 2026. The oversupply of trucking capacity seems to have been corrected…even more so with the increased regulatory enforcement focused on the driver populations. Yet, the real turning point of the market still seems to be focused on what is going to happen to freight demand. The overall economy has the largest say on whether freight demand increases, decreases, or stays flat. How the consumer-driven US economy will respond to healthcare cost fluctuations, inflation, tariffs, and evolving regulatory and political landscapes is a topic for expert economists…of which I am not one. Current predictions of 2.0-2.5% US GDP growth in 2026 would be an improvement compared to the uncertainty-laden 2025. This level of growth should at least sustain, and likely increase, freight demand.

So where does all this lead in regard to pricing for truckload freight?

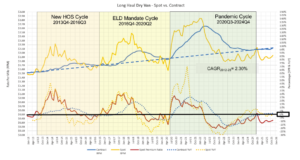

Before the massive, COVID-induced inflationary and deflationary cycles in TL pricing, the average market movement for TL was 2-3% per year. Even taking into account the swings of the pandemic cycle, the most recent 13-year period for TL freight prices has yielded a compound annual growth rate (CAGR) of only 2.3% (Source: DAT).

Source: DAT IQ Monthly Signal Report – December 2025

With carrier capacity continuing to exit the market, spot rates are likely to go up and finally become higher than contract rates again. Increased volumes will be necessary to maintain the higher spot rates (which did not occur in 2025). Assuming volumes improve in 2026, then those elevated spot rates will eventually start pulling contract rates up as well.

Load volumes typically are muted at the beginning of the year until we get fully into springtime. So, similar to our prediction last year, we expect pressure will build as we move through the year, with the larger increases coming in the 2nd half of the year. Thus, we expect overall truckload rates to increase 3-4% in 2026.

Conclusion: Planning for an Uncertain Future

Diversification remains the name of the game when building a resilient transportation strategy that can deal with the volatility inherent in today’s supply chains. Suggested actions to diversify your transportation portfolio include:

- Use intermodal when cost and transit times permit

- Construct a provider base with a mix of asset-based and non-asset-based providers and utilize them on the lanes where it makes sense (assets on consistent lanes, non-asset on the more variable lanes)

- Maintain enough transport provider relationships with consistent volume so your organization has partners invested in your success and willing to provide capacity when volumes spike

- Strive to be a “shipper of choice” that minimizes the time carriers spend waiting at your shipping and receiving locations

- Evaluate the applicability, size, and mission of private or dedicated fleets in your network

In 2026, truckload rates will be influenced by a complex and uncertain mix of economic conditions, regulatory changes, technological innovation, and shifting societal trends. For carriers and shippers, staying agile and informed will be critical. Those who plan ahead and adapt to these forces won’t just weather the changes—they’ll position themselves to thrive in a market that’s evolving faster than ever.

This is the first in a set of four articles from the North America Transportation Practice. The second article is here: 2026 Less-than-Truckload (LTL) Rate Outlook: Discipline versus Demand