Guest author: Jim Haller, Director, Consulting Channel, AFS Logistics

[email protected]

The predictability once associated with parcel pricing driven primarily by annual General Rate Increases (GRIs) is a thing of the past. Sure, GRIs are still a thing — both UPS and FedEx implemented a 5.9% GRI for 2026 — but shippers are discovering that headline rate increases tell only a fraction of the story.

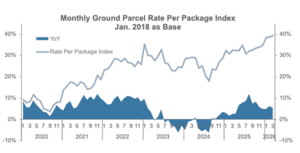

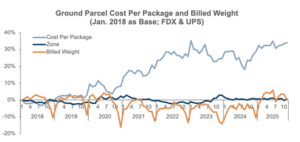

The latest TD Cowen/AFS Freight Index backs this up. Its data shows that higher accessorial charges, rating logic changes and network design decisions by carriers are driving parcel cost inflation far more than base transportation rate increases.

As shippers head deeper into 2026, making sense of these structural cost drivers, and how carriers are using them, will be critical to maintaining budget control and service performance.

The 2026 GRI: familiar number, very different impact

Given that their topline GRIs for 2026 were identical to their average increases in each of the last two years, on paper it doesn’t appear carriers are doing anything extraordinary to guard margins despite prolonged soft demand. But when you look just below the surface, it’s obvious that the carriers are relying heavily on subtle-yet-potent actions, including not only surcharge increases, but also rating adjustments, to make their numbers.

Take fuel surcharges for example. Despite only modest increases in diesel prices, carrier fuel surcharges increased materially on a year-over-year basis. For ground parcel, a 4.7% rise in diesel prices translated into a 26% increase in carrier fuel surcharges.

So, if, as a shipper, you’re feeling like cost increases are disconnected from market fundamentals, it’s because they often are.

Accessorials are now the primary cost lever

The Freight Index shows that accessorial charges are now the dominant driver of parcel cost per package (CPP), especially for ground shipments.

In Q4 2025:

- Ground parcel CPP increased 1.8% quarter-over-quarter

- Average accessorial cost increased 13% quarter-over-quarter

- Demand surcharges and residential delivery surcharges accounted for the majority of the increase

The result was a ground parcel CPP that was driven to record levels, setting the stage for another projected record in Q1 2026. This shift shows that carriers are overhauling their pricing strategy. Instead of relying solely on base rate increases, carriers are:

- Expanding surcharge categories

- Broadening surcharge eligibility

- Increasing minimum billable weights

- Adjusting dimensional rating logic

For shippers, this means the true price of parcel shipping is increasingly determined by how shipments are rated, not what the published rate chart says.

Network design is now a pricing strategy

Carriers aren’t just transporting packages; they’re pricing network behavior.

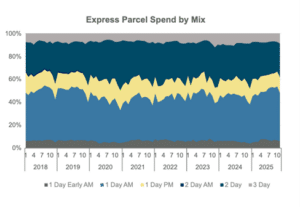

According to the Freight Index, residential delivery mix, oversized packages and service-level shifts all significantly influence CPP. In Q4 2025, seasonal increases in residential shipments amplified the impact of surcharges, while changes in service mix — such as greater use of deferred services — hid some of the base-rate increases but didn’t offset accessorial growth.

What this means is that your pricing outcome is now directly determined by:

- Where you ship

- How your packages are sized

- Which service type you choose

- How your network is structured

For many shippers, the parcel contract has shifted from primarily governing total cost to dictating the physical and operational design of their shipping network.

FedEx vs. UPS: different levers, same outcome

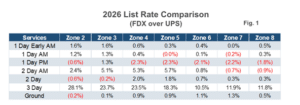

Although FedEx and UPS generally continue marching in lockstep with base rate structures, their surcharge and rating approaches are just different enough to create meaningful cost divergence based on shipper profile.

Notable distinctions between the two carriers in 2026 include:

- Differences in the way large package and oversize surcharges are treated

- Slight gaps in the fuel surcharge indices

- Service-specific rating logic adjustments

Although FedEx might seem to show advantages in more surcharge categories overall, most of the pricing gaps between the two carriers are less than 1%, reinforcing that neither carrier is clearly “cheaper” in a broad sense. Instead, the carrier that is better for your needs depends on your shipment profile, dimensions, zones and service mix.

What this means for shippers in 2026

The bottom line is that parcel cost increases in 2026 are being driven more by structural pricing mechanisms embedded in carrier rules than by list-rate inflation. This has three major implications for shippers:

- Contracts matter less than execution – a strong discount doesn’t mean much if shipment characteristics like package dimensions and weight trigger penalties.

- Network strategy is now a pricing strategy – facility placement, zone skipping and mode selection directly influence cost.

- Visibility into pricing isn’t optional, it’s critical – without granular insight into surcharge composition and rating logic, shippers will have no idea why costs increase.

A smarter approach to parcel cost control

Parcel pricing is getting more complicated by the day. As a result, shippers need to shift from reactive negotiation to proactive design. What that boils down to is:

- Annual benchmarking using real market data

- Auditing surcharge exposure by category

- Redesigning cartonization and packaging logic to skirt surcharges

- Evaluating alternative carriers and hybrid networks

- Leveraging regional carriers and postal injection when possible

In an environment where pricing discipline is tightening and carrier networks are being optimized for yield, shippers have to exercise the same level of discipline in how they ship. The winners in 2026 won’t be the shippers who negotiated the biggest discounts. They’ll be the ones who understand how to build new shipping strategies based on how their shipments are truly being priced.

This is the third in a set of four articles from the North America Transportation Practice and guests.

The first article is here: 2026 Truckload Rate Outlook: where do we go from here? The second article is here: 2026 Less-than-Truckload (LTL) Rate Outlook: Discipline versus Demand

Guest author: Jim Haller, Director, Consulting Channel, AFS Logistics, [email protected]

If you would like to reach out transportation practice, reach out to Kevin, Rob and Neal through this form.